Making Debt Management easier than ever before.

Bank Relationship Management (BRM) is all about managing the relationships you have with the Financial Institutions. So much depends on the perception that they have of your company and the way you manage the interactions between you and them. By financial Institutions we’re referring to Banks (Local and Multinational Banks), Specialized Institutions (like Renting Companies, Leasing Companies, Factoring Companies,…), Insurance Companies (General Insurances and Credit Insurance Companies), Rating Agencies (Short term Rating and Long term Rating), Regulators (Government and Market regulators) and Third Parties (Brokers, Consultants and Auditors).

Challenge

CFOBRM is a software specially made for Total Cost of Debt Ownership (TOCODO), a specialized financial tool designed to help businesses and organizations calculate and manage the overall expenses associated with their debt obligations over time. This type of software is particularly valuable for financial managers, CFOs, and decision-makers who need to understand the true cost of borrowing and make informed financial decisions.

Here are some key features and components you might find in a TOCODO software:

-

Debt Profile Management: The software allows users to input and manage details about their debt instruments, including interest rates, principal amounts, terms, and payment schedules.

-

Interest Rate Modeling: Incorporates interest rate forecasting and modeling tools to help users anticipate changes in interest rates and their impact on debt costs.

-

Payment Tracking: Users can input and track payments made towards their debts, ensuring accurate calculations of the remaining balance and interest paid.

-

Amortization Schedules: The software generates detailed amortization schedules, showing how each payment is allocated between principal and interest, enabling users to see the impact of different payment strategies.

-

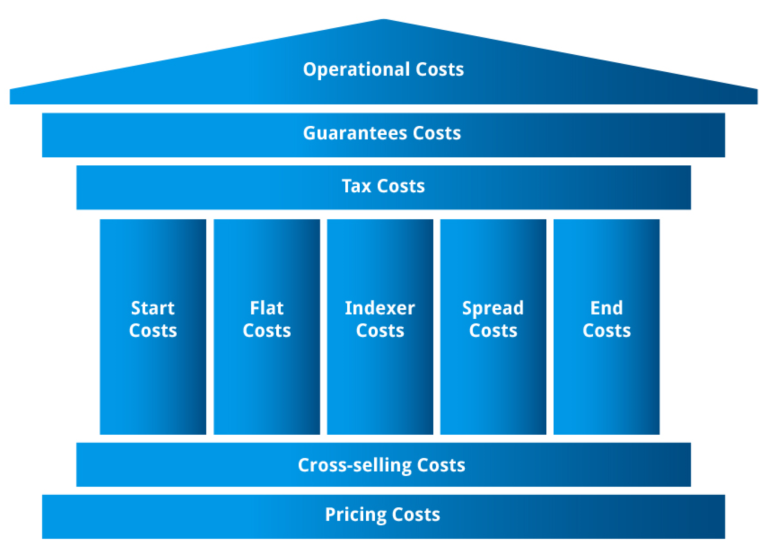

Cost Components: Breaks down the total cost of debt into various components, including interest expense, principal repayment, origination fees, and any other associated costs.

-

Scenario Analysis: Users can perform "what-if" scenarios to assess the impact of different interest rate environments or debt repayment strategies on the total cost of debt.

-

Customization: The software may allow for customization to adapt to various types of debt instruments, such as loans, bonds, or credit lines.

-

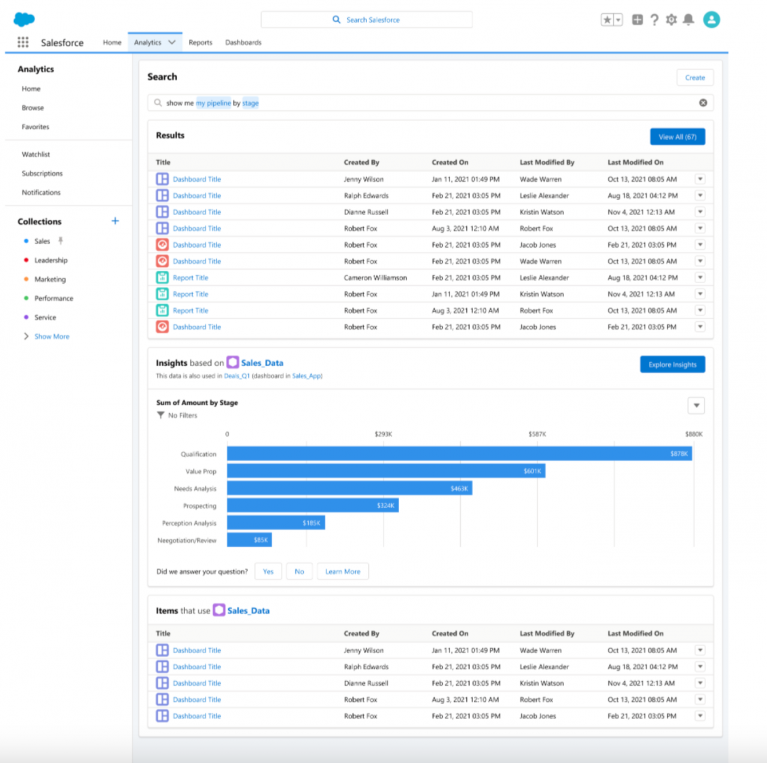

Reporting and Visualization: Provides clear and insightful reports, graphs, and charts that help users visualize and communicate the total cost of debt ownership to stakeholders.

-

Compliance and Regulatory Support: Offers compliance features to ensure that debt management practices adhere to relevant financial regulations and reporting standards.

-

Collaboration: Collaboration tools are included to facilitate communication and decision-making among team members involved in managing debt.

-

Security: Robust security measures to protect sensitive financial data, ensuring that confidential information remains confidential.

By using the CFOBRM software, organizations can gain a comprehensive understanding of their debt obligations, optimize their debt management strategies, and make informed financial decisions that minimize the total cost of debt ownership, ultimately improving their financial health and stability.

Solution

Creating this kind of software requires a structured approach and careful consideration of the variables involved. CFOBRM software is a financial solution that accounts for all the costs associated with acquiring, maintaining, and servicing debt over its entire life cycle:

-

Define Requirements:

- Begin by defining the requirements for your TCO software. What types of debt will it handle (e.g., loans, bonds, credit lines)? What factors will it consider (e.g., interest rates, fees, terms, amortization schedules)?

-

Data Input:

- Design a user-friendly interface for inputting all relevant financial data. Users should be able to input details about the debt, such as the principal amount, interest rate, term, and any fees.

-

Data Validation:

- Implement data validation to ensure that users enter accurate and valid information. Check for errors and inconsistencies in the input data.

-

Calculate TCO Components:

- Break down the ToCoDo into its components, which may include:

- Interest payments

- Principal repayments

- Fees (e.g., origination fees, annual fees)

- Taxes (if applicable)

- Insurance (if applicable)

- Prepayment penalties (if applicable)

- Break down the ToCoDo into its components, which may include:

-

Amortization Schedule:

- Generate an amortization schedule if the debt involves periodic payments. This schedule should detail how each payment is divided between principal and interest.

-

Interest Rate Variability:

- Account for variable interest rates if your software will handle loans with changing rates. You may need to incorporate interest rate forecasting or historical data for this purpose.

-

Time Value of Money:

- Consider the time value of money by discounting future cash flows to present value if necessary. This step is particularly important for long-term debts.

-

Report Generation:

- Develop a reporting module that presents the TCO in a clear and understandable format. Include charts, tables, and summaries to help users interpret the results.

-

Sensitivity Analysis:

- Provide an option for sensitivity analysis, allowing users to explore how changes in input variables (e.g., interest rates, fees) affect the TCO.

-

Integration:

- If your software will be used within an organization, consider integrating it with other financial systems, such as accounting software or financial planning tools.

-

Testing:

- Thoroughly test the software to ensure it calculates TCO accurately and handles various scenarios and edge cases without errors.

-

User Documentation:

- Create user documentation that explains how to use the software, its assumptions, and limitations.

-

Security and Compliance:

- Ensure that the software complies with data security and privacy regulations if it involves handling sensitive financial information.

Developing this software was quite complex, and it was essential to engage with financial experts who understood debt management and financial modeling to ensure the software's accuracy and effectiveness.

Result