Manaing the Debt Ownership in a fashionable and easy way.

Mojaloop is a groundbreaking open-source platform designed to foster financial inclusion on a global scale. Developed by a collaborative community of experts, Mojaloop aims to create interoperability among diverse financial systems, enabling seamless and secure digital transactions. By providing a robust foundation for connecting financial institutions, mobile network operators, and users, Mojaloop strives to empower underserved populations with access to affordable and efficient financial services. With its innovative architecture and commitment to open standards, Mojaloop is poised to revolutionize the way financial systems interact, bridging gaps and transforming the landscape of inclusive finance.

Challenge

The implementation of Mojaloop's financial hub presents a multifaceted challenge at the intersection of technology, finance, and inclusivity. As an open-source platform designed to foster interoperability among various financial systems, Mojaloop aims to bridge the gap between the underserved and formal financial services. This ambitious endeavor requires overcoming intricate technical hurdles and navigating complex regulatory landscapes.

Technically, ensuring seamless connectivity and interoperability across disparate payment systems demands the creation of a robust, scalable, and secure architecture. The challenge lies in harmonizing divergent technologies, protocols, and data formats while maintaining data integrity and privacy. Handling high-volume transactions in a fault-tolerant manner, while also considering low-bandwidth or unstable network conditions, adds another layer of complexity.

Moreover, Mojaloop's mission extends beyond technology to address financial inclusion. Implementation must be cognizant of cultural, regulatory, and economic variations across regions and countries. Ensuring compliance with local regulations and promoting trust among financial institutions, mobile network operators, and users poses a considerable challenge. Balancing innovation with adherence to standards and regulations is crucial to ensure the platform's credibility and sustainability.

In summary, the implementation of Mojaloop's financial hub is a profound undertaking that requires the harmonization of technology, finance, and social impact. Successfully addressing the technical intricacies and navigating the diverse global financial landscape while promoting inclusivity and bridging gaps in financial services will define the success of this ambitious endeavor.

Solution

Implementing Mojaloop's vNext (next version) involves a comprehensive approach to enhance the platform's capabilities and ensure continued success in fostering financial inclusion. Here's a suggested solution:

- Technology Stack Enhancement:

- Upgrade underlying technologies and frameworks to ensure scalability, security, and performance. Adopt the latest versions of programming languages, databases, and infrastructure components to accommodate growing transaction volumes and evolving security requirements.

- Modular Architecture:

- Refine Mojaloop's architecture to be more modular and extensible. This allows for easier integration of new features and services. Microservices architecture can enable more agile development and scalability, while maintaining interoperability standards.

- Real-Time Transaction Settlement:

- Implement real-time transaction settlement to reduce delays and improve the user experience. Explore the integration of instant payment systems and technologies, ensuring that fund transfers are executed swiftly and securely.

- Enhanced Security Measures:

- Prioritize robust security measures, including advanced encryption, multi-factor authentication, and biometric verification. Implement secure coding practices and conduct regular security audits to safeguard sensitive financial data.

- Advanced Analytics and Reporting:

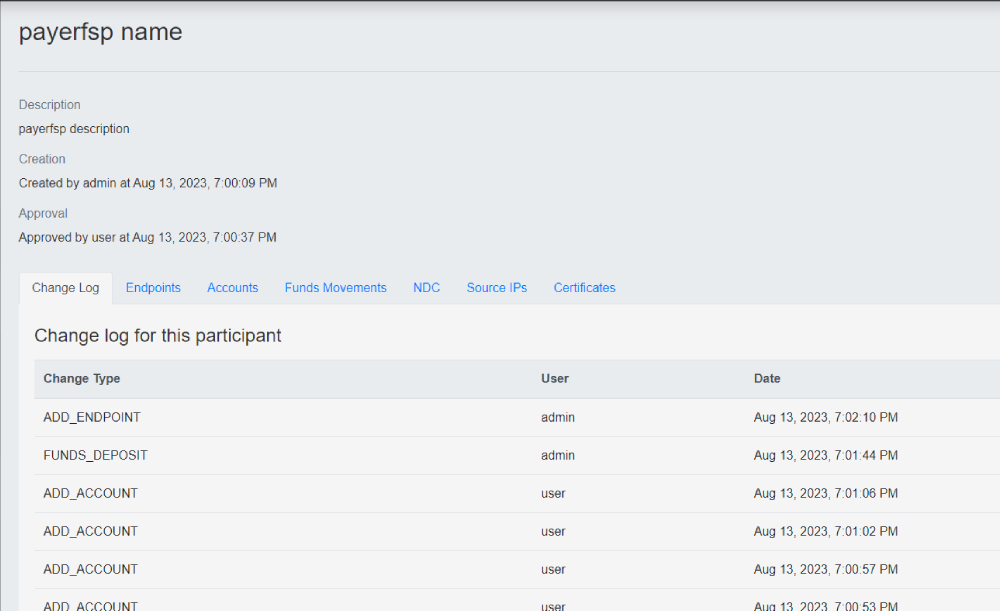

- Integrate advanced analytics capabilities to provide insights into transaction trends, user behaviors, and performance metrics. This data-driven approach can aid in refining services and making informed decisions.

- Regulatory Compliance Tools:

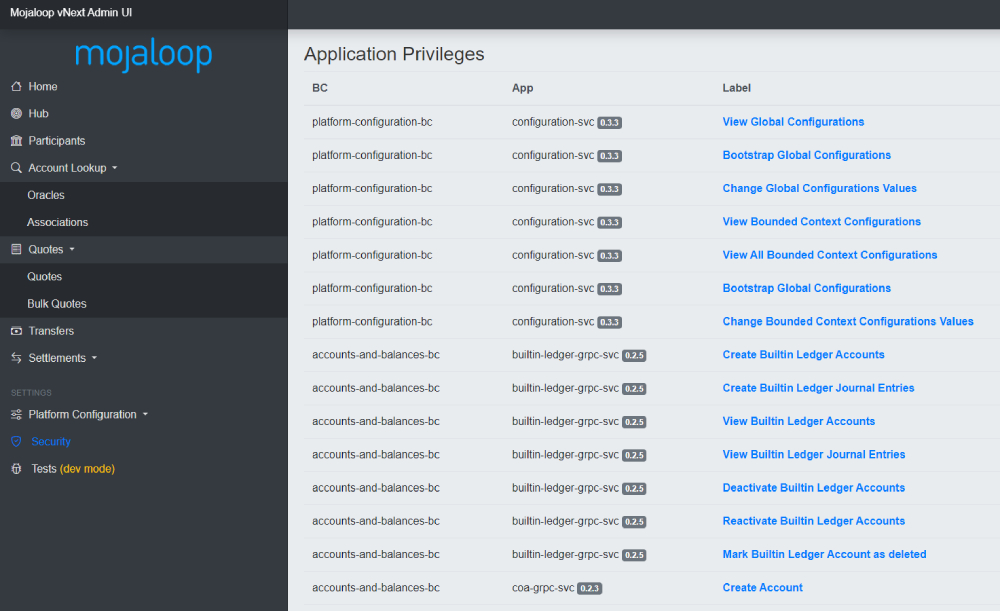

- Develop tools and features that assist financial institutions in adhering to evolving regulatory standards across different jurisdictions. This includes automated reporting, KYC/AML processes, and audit trails.

- UX and Accessibility Improvements:

- Enhance the user experience by improving the platform's user interface, ensuring it's intuitive and accessible to diverse user groups. Consider features such as localization and support for assistive technologies.

- Developer Ecosystem Enrichment:

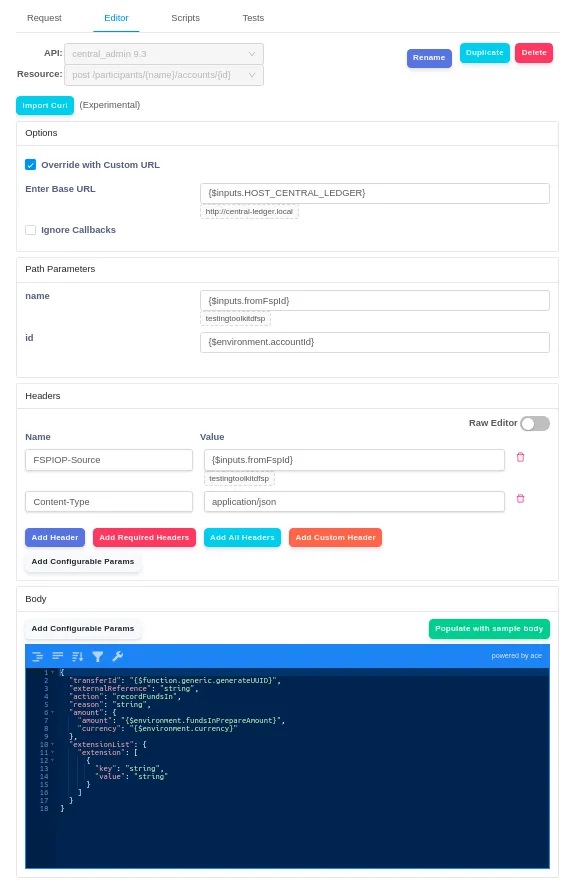

- Provide comprehensive documentation, SDKs, and APIs to encourage third-party developers to build upon the Mojaloop platform. Foster an active developer community that contributes to the platform's growth.

- Interoperability Expansion:

- Continue collaborating with financial institutions, mobile network operators, and regulatory bodies to expand the Mojaloop network's reach. Establish partnerships to connect with more stakeholders globally.

- Continuous Testing and Quality Assurance:

- Implement rigorous testing, including automated testing and continuous integration, to maintain the platform's stability and reliability. Regularly conduct load testing to ensure optimal performance under varying conditions.

- User Education and Training:

- Offer educational resources, workshops, and training sessions to ensure users and partners understand the capabilities and best practices of the new Mojaloop vNext. This can enhance adoption and utilization.

- Migration Plan:

- Create a detailed migration plan that ensures a smooth transition from the current version to vNext. Include data migration strategies, backward compatibility considerations, and a phased rollout approach.

By addressing these aspects, the implementation of Mojaloop's vNext can position the platform as a more powerful and inclusive tool for transforming global financial systems and promoting economic empowerment.

Result