Process automation and optimization of documentation purposes.

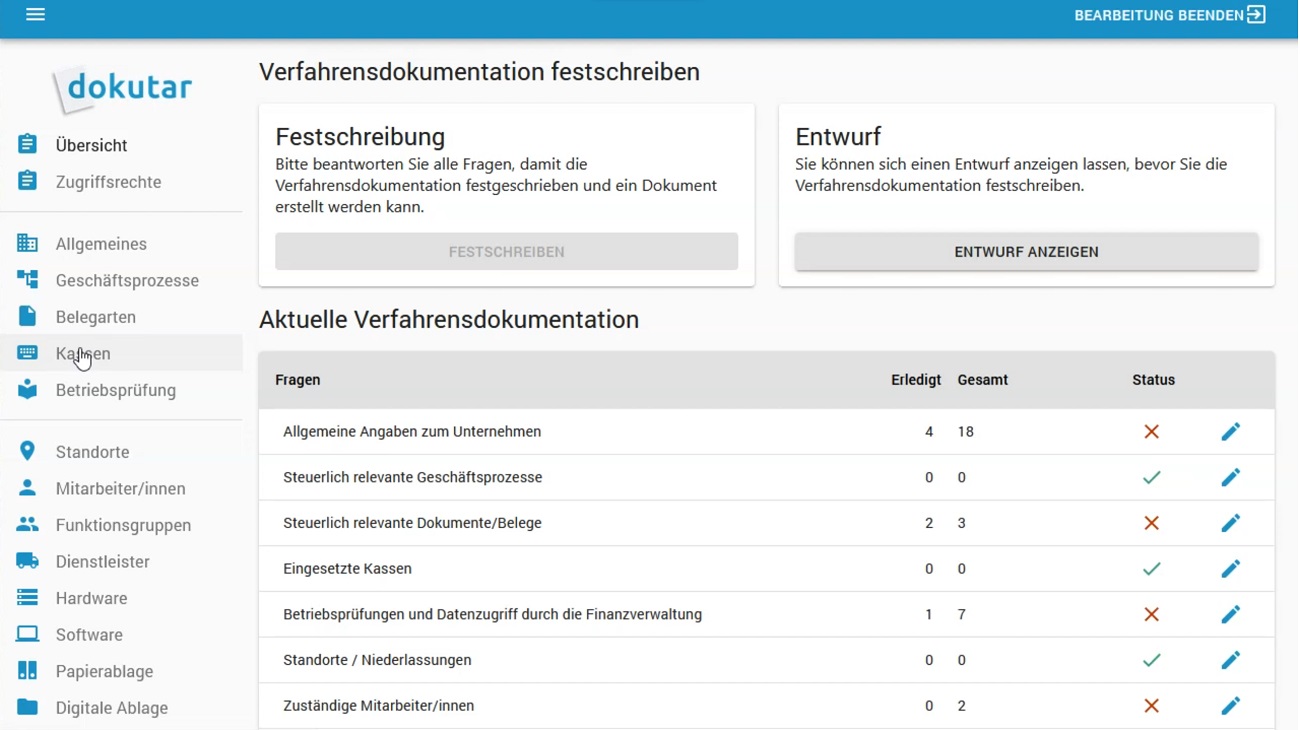

Dokutar is a cloud-based software for creating process documentation. The software is designed in such a way that you, as a freelancer and entrepreneur, are able to create process documentation for your company. dokutar guides you through the various complexes of questions and supports you with explanations and information at the crucial points. This saves time and money and lets you look forward to the next tax audit.

Challenge

Software meant for tax purpose process documentation in the cloud is a digital tool designed to streamline and manage the documentation and compliance processes related to taxation. Key features of such software typically include:

-

Document Storage and Management: The software allows users to store and organize tax-related documents, such as financial records, invoices, receipts, and tax forms, in a secure cloud-based environment.

-

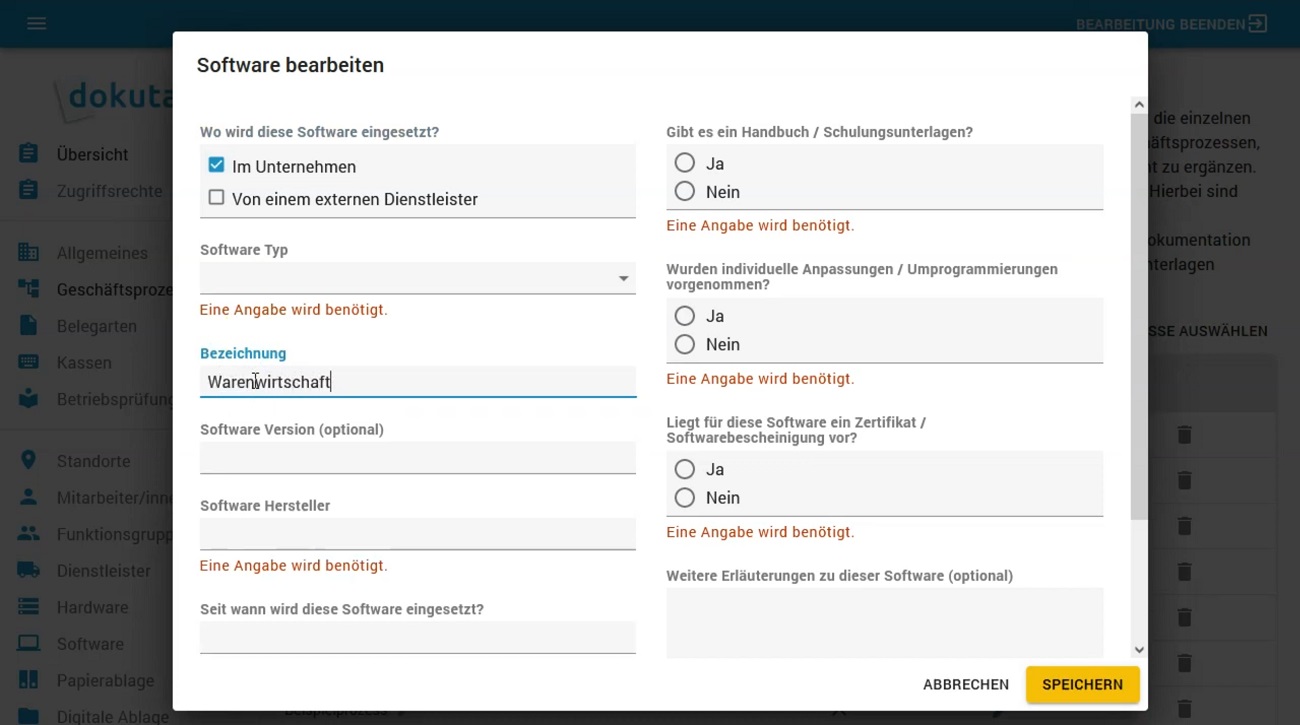

Data Capture and Extraction: It has capabilities to automatically extract and capture relevant data from documents, reducing manual data entry errors and saving time.

-

Workflow Automation: The software offers workflow automation features that guide users through the tax documentation process, ensuring all necessary steps are completed.

-

Collaboration: Users can collaborate with colleagues or tax professionals in real-time, facilitating the review and approval of tax documents.

-

Version Control: It includes version control to track changes and updates to documents, ensuring compliance with tax regulations.

-

Compliance Checks: The software might include compliance checks and alerts to notify users of potential issues or discrepancies in tax documentation.

-

Security and Encryption: Robust security measures are usually in place to protect sensitive tax information, including data encryption and access controls.

-

Integration: Integration capabilities with accounting software and tax filing systems help streamline the entire tax process, from documentation to submission.

-

Reporting and Analytics: The reporting and analytics tools provide insights into tax-related data, helping businesses make informed decisions.

-

Audit Trails: Detailed audit trails help track all activities related to tax documentation, ensuring transparency and accountability.

-

Cloud Access: Being cloud-based, users can access their documents and data from anywhere with an internet connection, enhancing flexibility and remote work capabilities.

-

Compliance with Regulations: The software is designed to comply with tax regulations and standards, ensuring that businesses meet their tax obligations accurately.

Result